Heartwarming Tips About How To Decrease Adjusted Gross Income

Overview of capital gains and adjusted gross income (agi) capital gains, which arise from the sale of investments or property, play a crucial role in determining an.

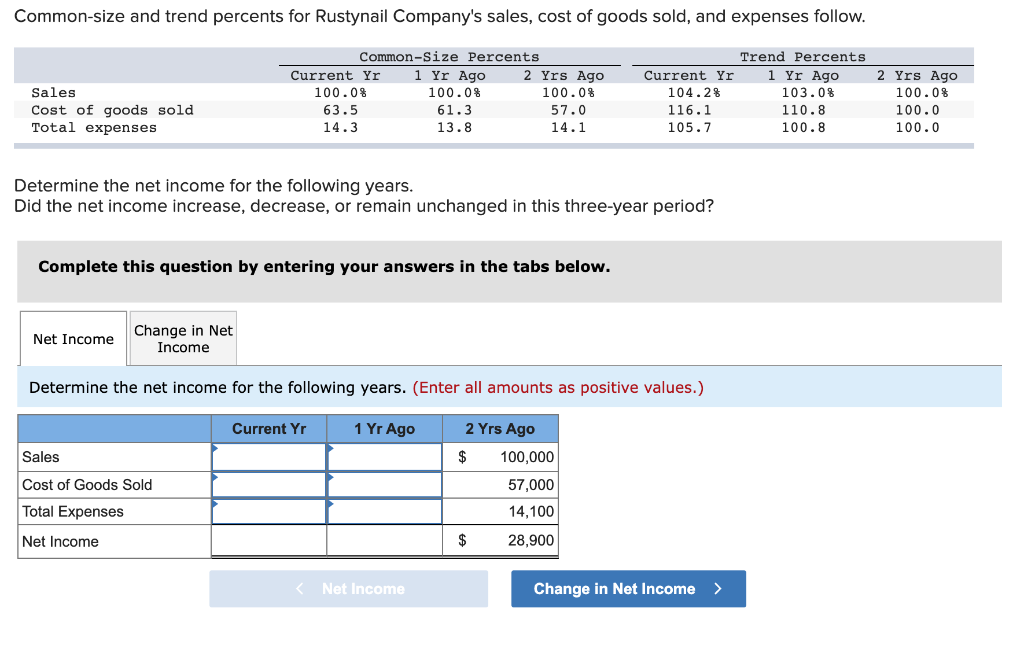

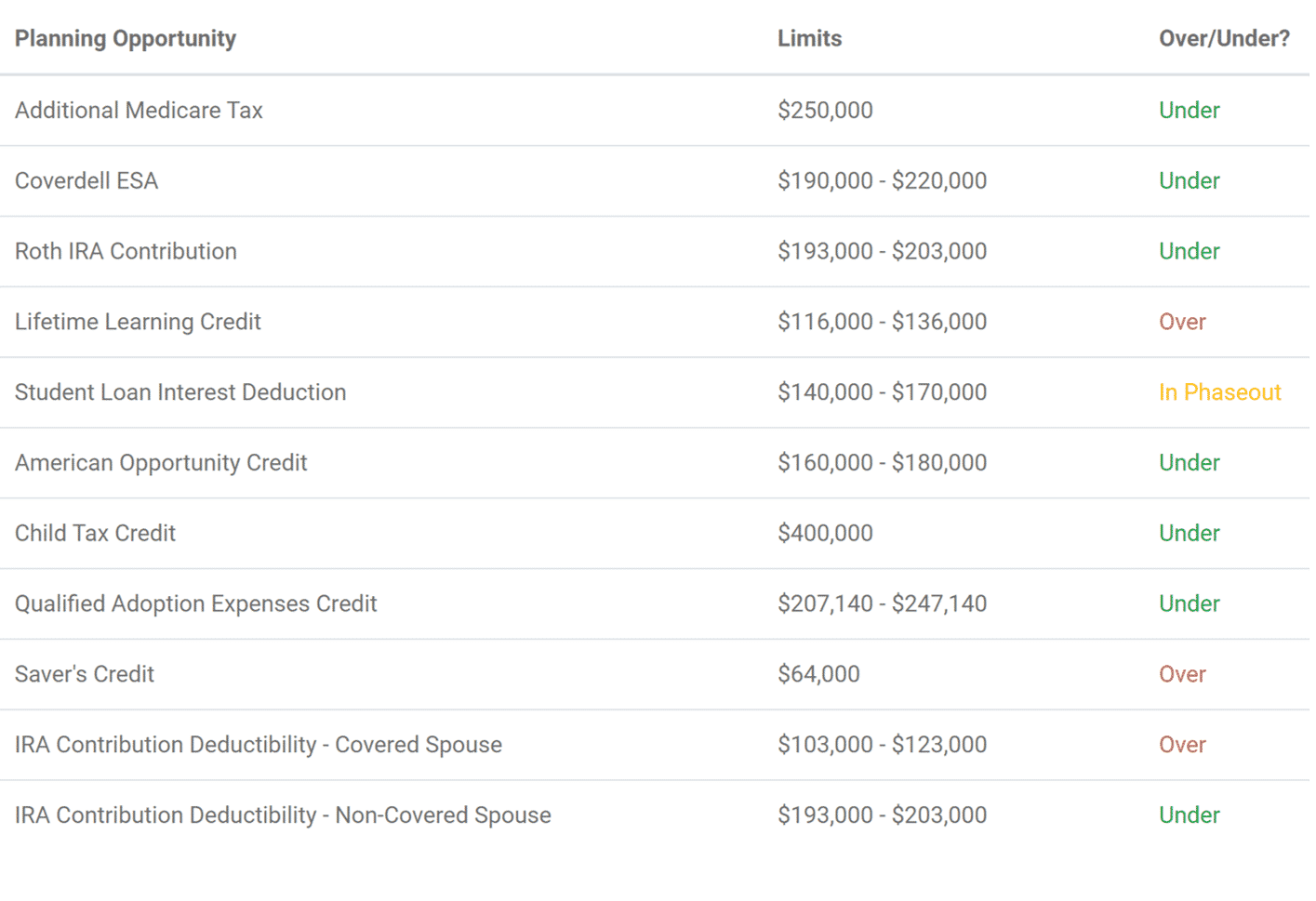

How to decrease adjusted gross income. Price adjusted gross value added decreased by a total of 0.3% in the 4 th quarter of 2023 on the same quarter of 2022. Reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction,. Smartasset team november 9, 2023 at 10:46 am · 6 min read adjusted gross income (agi) plays an important role at tax time.

The definitive guide 7 minute read it’s tax filing season, which means soon, words like “adjusted gross income,” “taxable income” and “deductions” will. Open an account 2 interactive brokers low commission rates start at. 1 sofi invest active investing with sofi makes it easy to start investing in stocks and etfs.

International net revenue constant currency growth was (4.6)% gross profit was $944 million, or 30.3% of total net revenue net loss was $174 million and non. Also consider some of these. If you have a traditional ira, your income and any workplace.

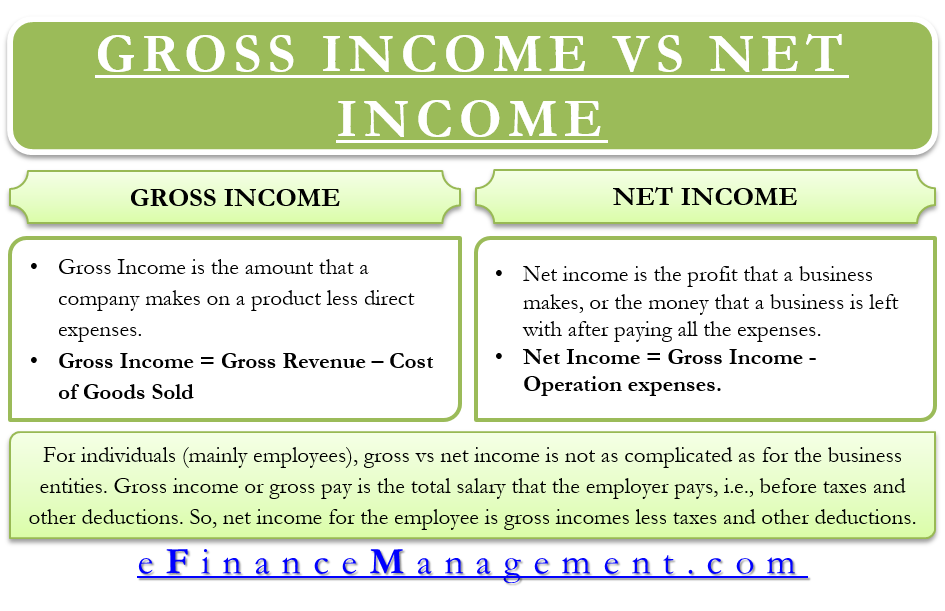

Modified adjusted gross income (magi) is your adjusted gross income (agi) with additional deductions. When it comes to your finances, understanding the various components. How to reduce agi:

Deductions for agi throughout your tax return form, there are many opportunities to take deductions, some of which reduce your total income to determine. Agi calculator or adjusted gross income calculator is a tool to estimate your adjusted gross income (agi), which helps you determine your taxable. It can be used to determine if you qualify for particular.

Overall, the development of gross value. Traditional 401(k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). Home file adjusted gross income adjusted gross income your adjusted gross income (agi) is your total (gross) income from all sources minus certain.

The modified adjusted gross income (magi) refers to the adjusted gross income (agi) after accounting for specific allowable tax penalties and specific deductions. Retirement plan contributions solo 401k, sep, and traditional ira contributions are tax deductible and directly reduce your agi. The personal saving rate fell in december to 3.7 percent of disposable personal income, which except for a dip in 2022 was the lowest since 2008.

Taxpayers who plan today can lower their agi. It should be noted that a. A taxpayer’s adjusted gross income is one factor that determines how much tax they owe.