Great Tips About How To Claim Vat At Airport

To be eligible to claim vat back, you must:

How to claim vat at airport. To do so, you will need to present your passport, boarding pass, and receipts for the items you are claiming to the vat refund office at heathrow airport. To claim a vat tool in uae airport, follow these. Arrive at the airport early.

Claiming a vat refund at the airport. Direction générale des douanes who can benefit from the tax refund (vat refunds)? How to claim vat refund at helsinki airport.

These receipts should show that you paid vat on the items. Before leaving the uk, ensure that you. Yes, if you are a visitor from outside the eu, you can claim a vat refund on goods purchased in the uk that you're exporting.

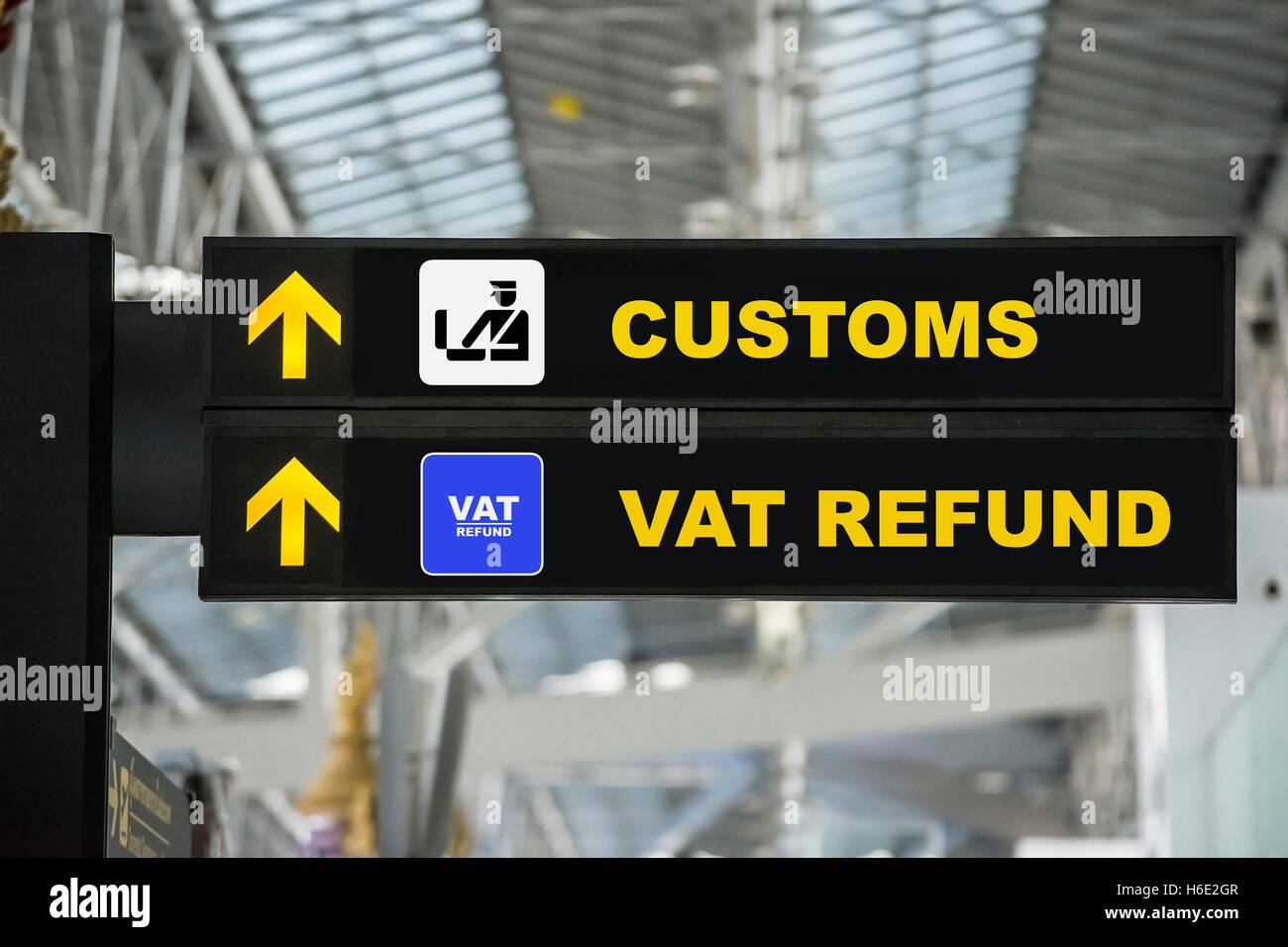

Where do i go to claim the vat refund at the airport? To get paid, either take your approved form to the vat refund desk at the airport, or send it to the retailer or refund provider with evidence of where you’re travelling to. All your questions about travelling through the airport answered.

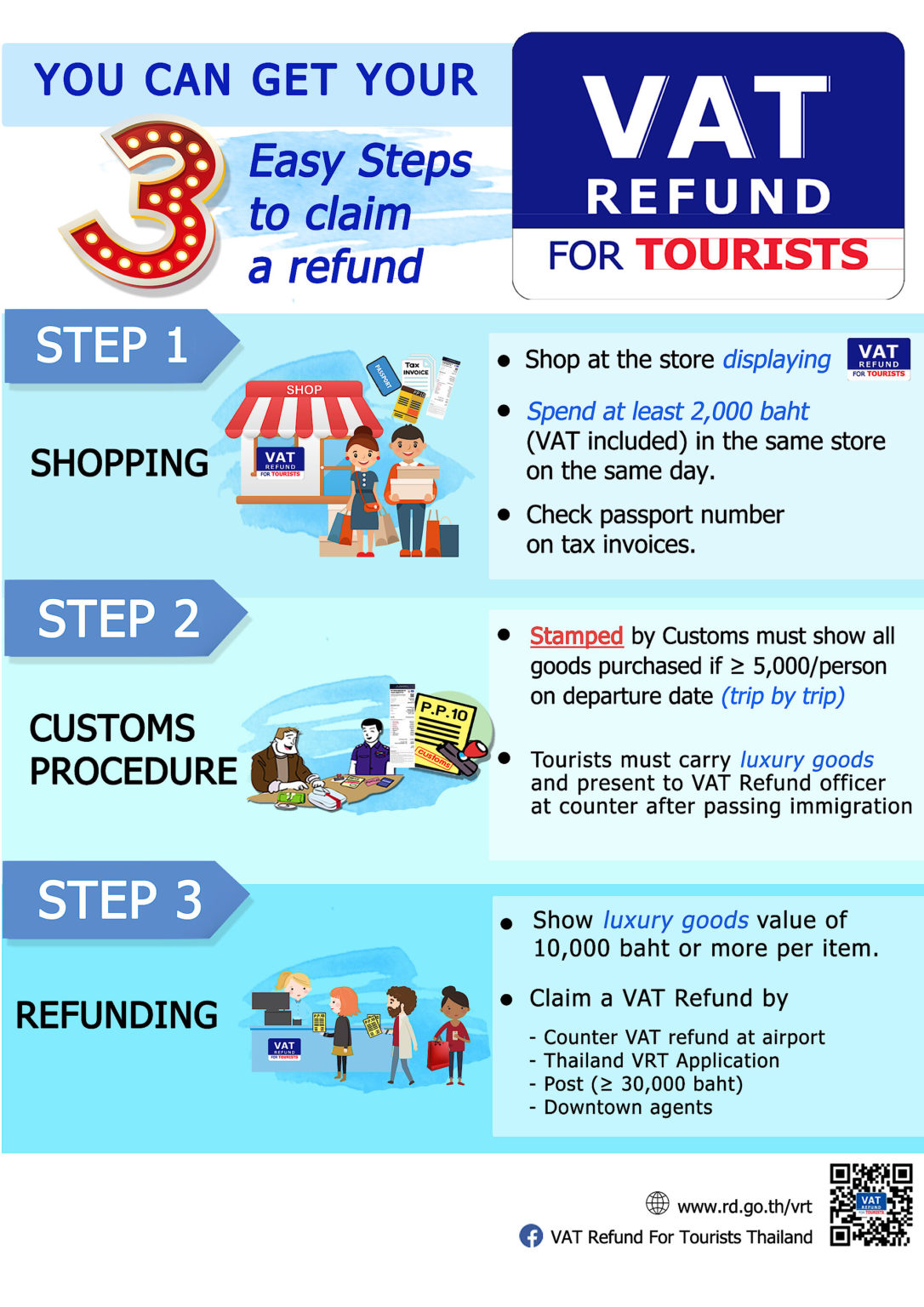

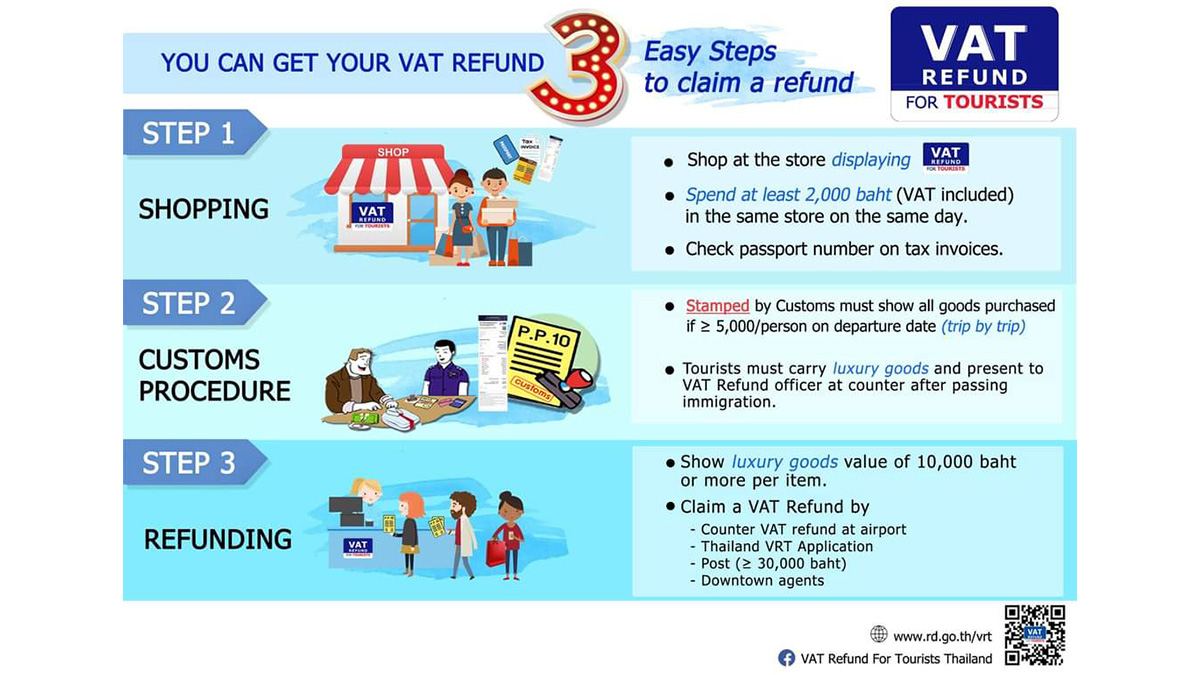

How to claim your vat refund at heathrow at the store: The tax refund can be granted to the buyer who follow those 3 conditions: One option is to claim vat refunds at the time of purchase while you’re shopping in rome.

Upon your departure from the uk, go to the customs desk at the airport before checking in your luggage. Before you leave the country, visit the vat refund desk at the airport. You can claim your vat refund in bigger airports immediately, otherwise you will have to send the refund form to the address given in the shop.

To claim a vat refund, you must keep your receipts. How to claim the vat refund at venice marco polo airport.

To claim a vat refund at dubai airport, follow these simple steps: London stansted airport would like to send you marketing emails and sms regarding: How to collect vat refund?

When making a purchase, inform the retailer that you wish to claim a vat refund. The vat is paid on purchases within the eu.