Underrated Ideas Of Info About How To Buy A Lien

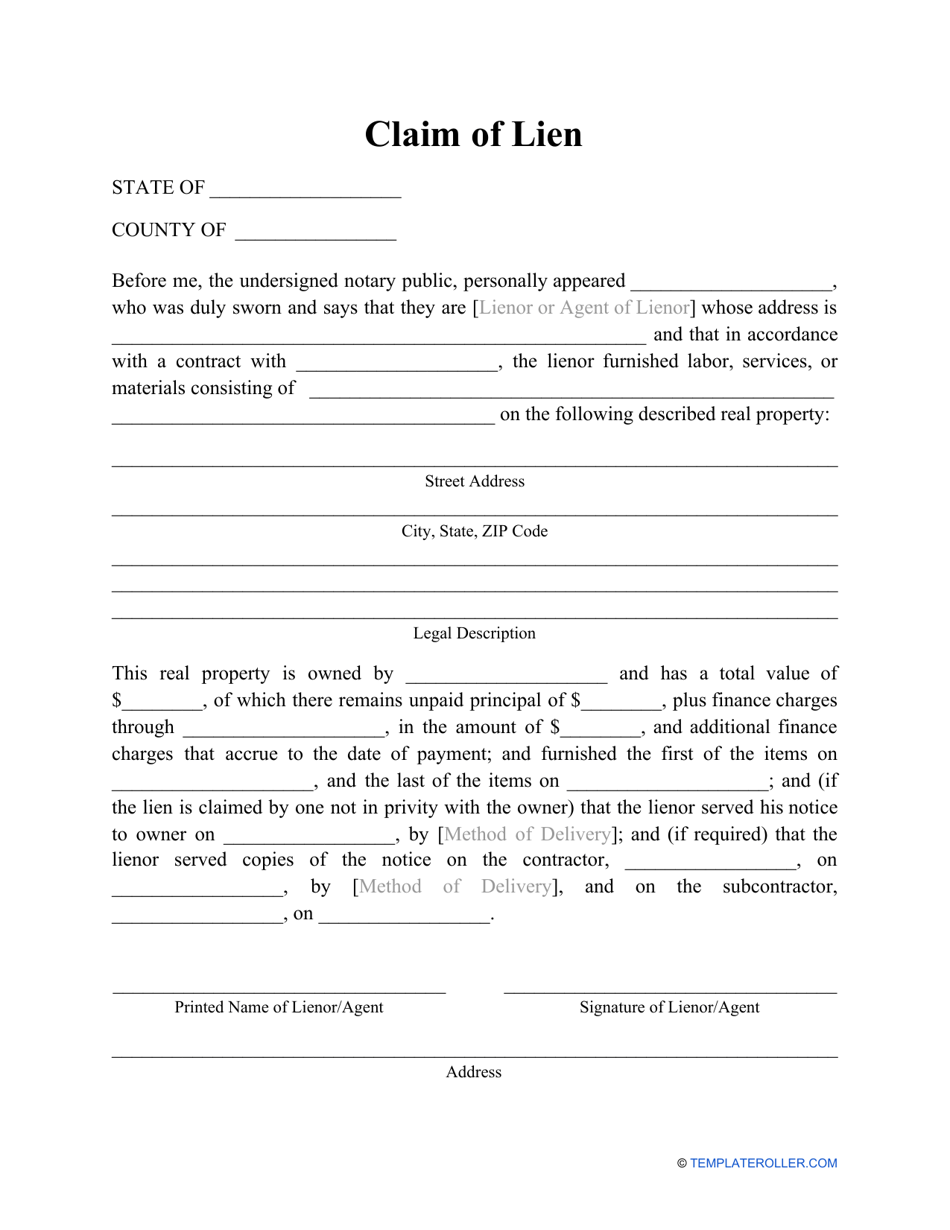

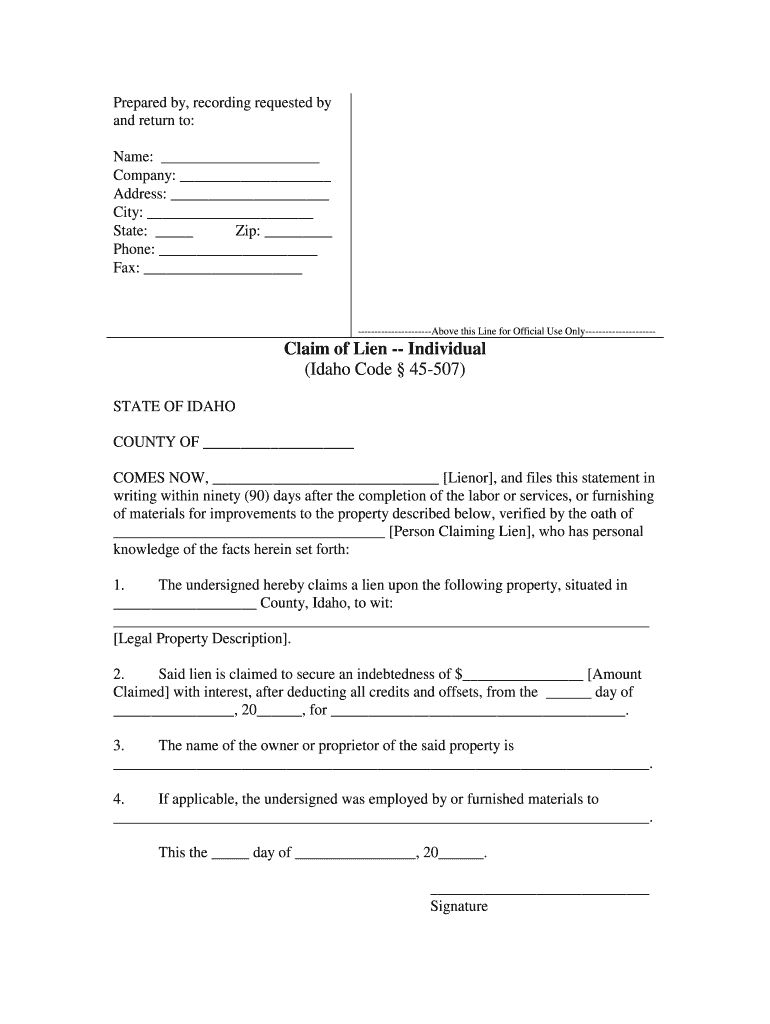

A tax lien allows you to purchase the right to collect unpaid property taxes from the current owner of the.

How to buy a lien. If you are interested in getting started, review the following steps to buying tax liens: If you are in the real estate market, you can look at your state's auction website to see what tax lien properties are available; How to buy tax liens:

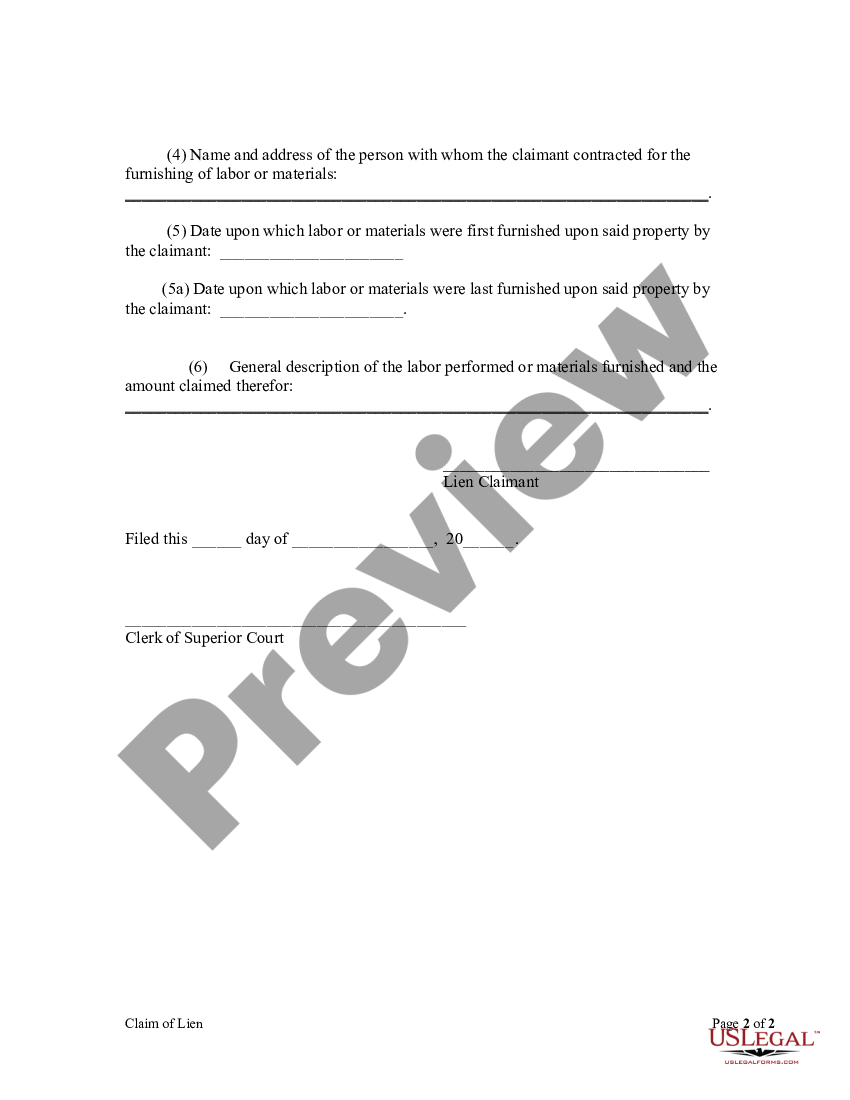

One way to buy a property with delinquent taxes is by buying a tax lien. First, you must identify properties with tax liens. If the lienholder is a bank that failed (or is a subsidiary of one), you will face a few extra steps.

Look out for tax lien certificates for sale. To find tax lien homes, you can start by researching local real estate markets. Or want to actually jump in and purchase some for yourself?.

Tax lien investing is an investment strategy in which investors purchase property tax lien certificates with the intent of collecting payments plus interest from the. If an owner fails to pay property taxes on time, a lien is placed on the tax lien property by the government or. Verify that the failed bank was placed.

Your borrower defaults, and you enter into a foreclosure. You can easily buy lien (lien) using fiat currency if doing so is supported. Tax lien certificates are commonly acquired through auctions, where investors bid for the right to purchase these.

Then establish a budget for the auction. Start by educating yourself about tax liens. To secure the payment of taxes owed by the property owner.

The best option will depend on how much time, money and expertise you have and whether you’re looking for a specific lien or all possible liens. You are now ready to buy lien (lien). However, buying a house with a tax lien can be a risky.

Let’s say you are a private lender with a first position mortgage for $100,000. Learn about tax liens and real estate auctions: Ever been interested in how tax liens work?